I've always been drawn to contrarian ideas – those that go against the grain of mainstream market sentiment. As I've been publishing my thoughts on Uneducated Investor over the last several months, the most-asked question by readers is:

What stocks should I buy to invest in [insert thematic here]? Is there an ETF?

While I prefer to hold a multitude of individual stocks spread across several thematics, I am acutely aware that many of my readers likely don't have the stomach for the volatility and complexity that often come with individual stock picks.

That's why I've put together a model portfolio allocation using exchange-traded funds (ETFs) to make these contrarian ideas more accessible.

ETFs have transformed the way we invest, providing a cost-effective and efficient way to gain exposure to specific sectors or themes. By holding a basket of securities, ETFs offer instant diversification, which can help smooth out the bumps that come with investing in individual companies. Plus, ETFs are often more liquid and easier to trade than individual stocks, making them a compelling choice for many investors.

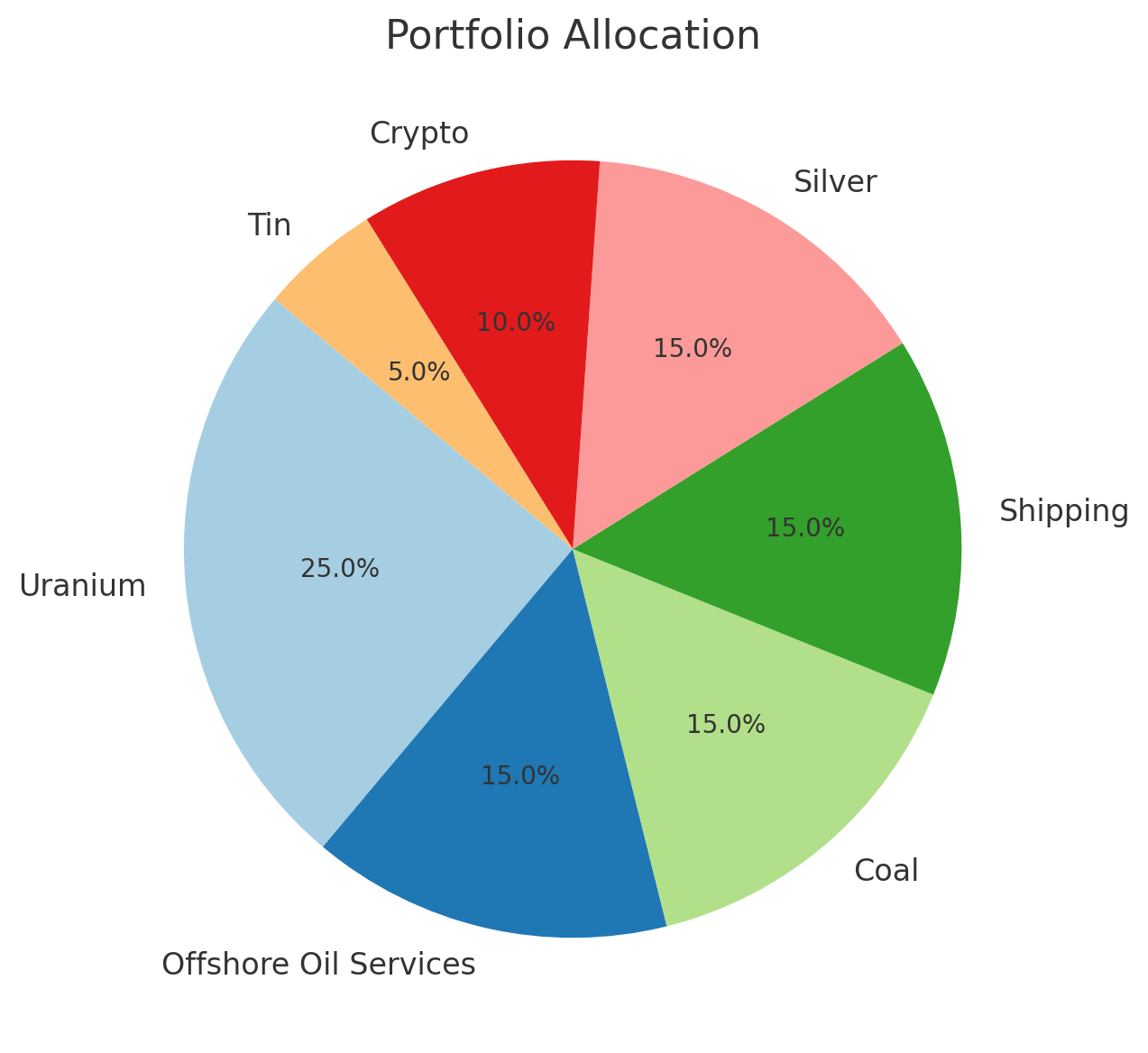

The Contrarian ETF Portfolio I've designed is meant for investors who are willing to allocate a portion of their portfolio (say, 10%) to unconventional investment ideas. The portfolio consists of ETFs focused on sectors like uranium, offshore oil services, coal, shipping, silver, cryptocurrency, and tin. Each of these sectors has its own unique bull case, driven by factors such as the shift to clean energy, the growth of global trade, and the rising demand for precious and industrial metals.

Here's a breakdown of the portfolio:

It's important to note that this Contrarian ETF Portfolio is not meant to be a standalone investment strategy. Instead, think of it as a satellite component of a well-diversified investment portfolio. Before allocating funds to this or any other concentrated investment strategy, investors should carefully consider their risk tolerance and investment objectives.

If you have read the disclaimers above and still want to proceed, then by all means, let's get on with the show.

Uranium - 25%

| Name | Symbol | Allocation |

|---|---|---|

| Sprott Physical Uranium Trust | U.U | 10% |

| Sprott Junior Uranium Miners ETF | URNJ | 15% |

The Sprott Physical Uranium Trust (U.U) provides exposure to physical uranium, while the Sprott Junior Uranium Miners ETF (URNJ) invests in junior uranium mining companies. The bull case for uranium is based on the increasing demand for clean energy and the potential for nuclear power to play a significant role in the transition to a low-carbon economy.

Offshore Oil Services - 15%

| Name | Symbol | Allocation |

|---|---|---|

| Range Global Offshore Oil Services ETF | OFOS | 15% |

The Range Global Offshore Oil Services ETF (OFOS) invests in companies that provide services to the offshore oil industry. The bull case for offshore oil services is based on the potential for increased offshore oil exploration and production as demand for oil continues to grow and onshore reserves become depleted.

Coal - 15%

| Name | Symbol | Allocation |

|---|---|---|

| Range Global Coal ETF | COAL | 15% |

The Range Global Coal ETF (COAL) invests in companies involved in the coal industry, including coal miners and coal-related infrastructure. The bull case for coal is based on the continued demand for coal in emerging markets and the potential for coal to remain a significant source of energy in the near to medium term.

Shipping - 15%

| Name | Symbol | Allocation |

|---|---|---|

| SonicShares Global Shipping ETF | BOAT | 15% |

The SonicShares Global Shipping ETF (BOAT) invests in companies involved in the global shipping industry, including container shipping, dry bulk shipping, and tanker shipping. The bull case for shipping is based on the potential for increased global trade and the growing demand for seaborne transportation of goods.

Silver - 15%

| Name | Symbol | Allocation |

|---|---|---|

| Sprott Physical Silver Trust | PSLV | 5% |

| Amplify Junior Silver Miners ETF | SILJ | 10% |

The Sprott Physical Silver Trust (PSLV) provides exposure to physical silver, while the Amplify Junior Silver Miners ETF (SILJ) invests in junior silver mining companies. The bull case for silver is based on its dual role as a precious metal and an industrial metal, with potential demand growth from both investors seeking a safe haven and industries such as solar energy and electronics.

Crypto - 10%

| Name | Symbol | Allocation |

|---|---|---|

| VanEck Bitcoin Trust | HODL | 10% |

The VanEck Bitcoin Trust (HODL) provides exposure to Bitcoin, the largest and most well-known cryptocurrency. The bull case for Bitcoin is based on its potential to serve as a digital store of value, a hedge against inflation, and a decentralized alternative to traditional currencies.

Tin - 5%

| Name | Symbol | Allocation |

|---|---|---|

| WisdomTree Tin ETC | TINM | 5% |

The WisdomTree Tin ETC (TINM) provides exposure to the price of tin. The bull case for tin is based on its use in various industries, including electronics and renewable energy technologies, plus the potential for supply constraints to drive prices higher.

Setting Up The Portfolio

You should be able to purchase these ETFs via any popular online brokerage. I use Interactive Brokers. If you don't have an account, signup via this link and we'll both receive some free stock from IBKR. 🙂

When integrating the Contrarian ETF Portfolio into a broader investment plan, investors should consider their overall asset allocation and risk appetite. This portfolio allocation is by no means set in stone. If there is a particular asset class you don't want exposure to (crypto, for example), feel free to remove it and adjust the allocations accordingly. As a rule, I have capped the exposure to any one thematic at 25%.

Closing Thoughts

Investors considering the Contrarian ETF Portfolio should be prepared for volatility, as it is an inherent part of contrarian investing. As the saying goes:

You can't have the pumps if you can't handle the dumps.

Embracing the potential for significant gains requires a willingness to weather the inevitable dips along the way.

Since contrarian investing means going against the consensus, it can sometimes leave you feeling like the odd one out. I remember the strange looks I received a few years ago when I first invested in uranium. Now, those same people are congratulating me on making a smart investment. The key is to size your positions appropriately, ensuring that you can sleep well at night and that a drawdown in any sector (or multiple sectors simultaneously) won't impact your daily finances.

To provide context for the performance of the Contrarian ETF Portfolio, I'll track its performance against the S&P 500, as this is the benchmark most retail investors use for their investments.

It's worth noting that in contrarian investing, a significant portion of an entire year's gains can sometimes materialize in just a few trading sessions. As the renowned investor Paul Tudor Jones once said:

The most money is made in the shortest period of time in the most volatile markets.

This highlights the importance of being well-positioned and having the conviction to hold through periods of uncertainty.

If you do decide to implement this portfolio, it's crucial to recognize that these are not buy and hold forever investments. These are cyclical industries that historically experience massive gains with blowoff tops, followed by steep crashes. The key to success is to exit positions in tranches, locking in the majority of the gains along the way. I'll leave you with one of my favorite quotes from Trader Ferg that's worth remembering.

Leave the game early. Miss some of the fun. That's the only way you get home safely. Everyone thinks they can watch the whole game and leave. That's not how the markets work.

Few people have the discipline to exit the party just as the strippers turn up.

Don't be that guy (or girl). When it's time, take the money and run!