The recent surge in copper prices to a 14-month high has caught the attention of investors and industry participants alike. Here's my perspective on the forces fuelling copper's breakout rally and its critical role in the unfolding energy transition.

Copper Prices Soar on Supply Risks and Demand Optimism

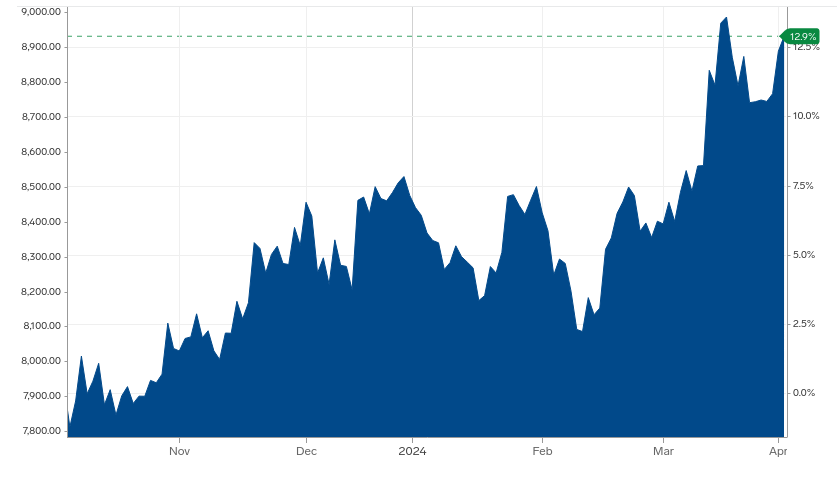

Let's start with the headline-grabbing news: Copper prices have jumped to their highest level in over a year, propelled by a potent combination of rising supply risks and growing optimism about a recovery in global demand. This rally, which began in early February, has seen the red metal climb as much as 12.9% in the last 6 months.

A key driver behind the surge has been mounting concerns over supply disruptions at major mines. The severity of these disruptions is evident in the historically high premiums that smelters are paying to secure mined ore. Further compounding the supply woes, Chinese plants, which account for over half of global refined copper production, are inching closer to implementing coordinated output cuts in response to the ore shortage.

On the demand side, tentative signs of a rebound in worldwide manufacturing activity are stoking hopes that tightening market conditions could propel copper prices to new all-time highs. While concerns linger about the health of China's property sector and other key copper-consuming industries, the broader demand outlook is turning increasingly bullish.

Beyond China, the massive infrastructure spending boom underway in India and the global frenzy surrounding artificial intelligence (AI) are expected to unlock substantial new sources of copper demand. I believe these emerging demand drivers, coupled with the supply challenges mentioned earlier, have set the stage for a potentially historic rally in copper prices.

Copper's Pivotal Role in the Energy Transition

Of course, no discussion of copper's outlook would be complete without examining its vital role in the global shift toward cleaner energy sources. As nations worldwide strive to decarbonize their economies, copper has emerged as an indispensable enabler of the energy transition.

The most visible manifestation of this trend has been the explosive growth in electric vehicle (EV) adoption. In 2021, global EV sales skyrocketed to 14 million units — a fourfold increase in just three years. This breakneck pace of growth is expected to continue as governments and automakers alike double down on electrification.

For copper, the EV boom represents a transformative demand driver. A typical EV contains about 3.6 times more copper than a traditional internal combustion engine vehicle. Moreover, the vast charging infrastructure needed to support the EV revolution is incredibly copper-intensive, with each charging station requiring between 1.5 and 17.5 pounds of the metal.

Copper Use in Electric Vehicles

Each type of EV uses considerably more copper than traditional vehicles with internal combustion engines. Copper usage for each vehicle type is listed below:

• Internal combustion engine: 23 kg

• Hybrid electric vehicle (HEV): 40 kg

• Plug-in hybrid electric vehicle (PHEV): 60 kg

• Battery electric vehicle (BEV): 83 kg

• Hybrid electric bus (Ebus HEV): 89 kg

• Battery-powered electric bus (Ebus BEV): 224–369 kg

Source: International Copper Association

Beyond EVs, copper's role in electrifying the global economy is set to expand dramatically in the coming years. The International Energy Agency projects that worldwide electricity demand will surge 86% by 2050, placing enormous strain on aging power grids. As nations scramble to upgrade and modernize their electrical infrastructure, copper's superior conductivity and cost-effectiveness make it the material of choice for wiring the future.

It's worth noting that the shift toward renewable energy sources is particularly copper-intensive. Solar and wind farms require approximately 2.5 times more copper per unit of energy produced compared to traditional coal or natural gas plants. For offshore wind installations, copper usage jumps to an eye-popping 7 times that of conventional power sources.

Supply Challenges Threaten to Widen Deficit

While the demand outlook for copper is undeniably bullish, it's crucial not to overlook the formidable supply-side challenges that threaten to create a widening deficit in the years ahead. Put simply, meeting the world's insatiable appetite for copper as the energy transition unfolds will be no easy feat.

To appreciate the scale of the challenge, consider this: Estimates suggest that meeting projected copper demand through 2050 will require mining nearly 1.4 billion pounds of the metal — a mind boggling figure that doubles the total quantity extracted throughout human history.

Making matters worse, much of the "easy" copper has already been mined. Modern copper extraction often involves moving significantly more material to yield the same quantity of refined metal compared to operations from a century and a half ago. Furthermore, many of the most promising untapped copper deposits are situated in remote, infrastructure-poor regions, adding to the complexity and cost of development.

The lengthy timeline from discovery to full-scale production further exacerbates the supply crunch. On average, new copper mines require a staggering 10 to 15 years to navigate the gauntlet of exploration, permitting, and construction before achieving commercial output. This extended lead time leaves precious little room for error in meeting the market's near-term needs.

Recent developments underscore the fragility of the copper supply chain. For instance, Ivanhoe Mines recently reported a 6.5% quarterly decline in output at its massive Kamoa-Kakula mining complex in the Democratic Republic of Congo, while drought conditions in neighbouring Zambia are jeopardizing the country's ambitious plans to expand mined copper output.

Against this backdrop, I believe the copper market is poised for a period of sustained supply deficits. While current shortfalls are relatively modest, I anticipate the gap between demand and supply to widen considerably as the energy transition gathers momentum. This structural imbalance bodes well for copper prices and producers alike, even as near-term economic headwinds create sporadic volatility.

Capitalizing on the Copper Megatrend

For investors seeking to capitalize on copper's increasingly bullish outlook, exchange-traded funds (ETFs) focused on copper miners offer a compelling avenue for participation. Sprott Asset Management has two ETFs that provide targeted exposure to the copper mining industry.

For those seeking a more speculative, high-growth approach, the Sprott Junior Copper Miners ETF (Ticker: COPJ) may be an attractive option. This ETF focuses on smaller-cap companies engaged in late-stage exploration or early-stage development of copper projects. While these junior miners often carry higher risk profiles, they also offer the potential for outsized returns and could become acquisition targets as senior producers seek to replenish their reserves.

I firmly believe that the confluence of soaring electricity demand, the EV revolution, the broader adoption of renewable energy, and the 'dark horse' demand of AI will create a perfect storm for copper demand in the decades ahead. Investors who recognize the immense potential of this often overlooked aspect of the copper story stand to benefit handsomely as the energy transition kicks into high gear.