Crypto Slumbers, But Doesn't Sleep

Even in the harshest of winters, you’ll always find some signs of life. Yes, you may have to look for it harder than usual, but it’s there. Developers quietly build. Corporations trial web3 partnerships. Venture funding continues. Trading volumes inch upwards though prices stay low. Like nature’s seasons, crypto moves in cycles. The patient ones who weathered dormancy now turn optimistic. Is crypto spring around the corner?

Here’s what you may have missed as you avoided the cold:

Bitcoin Charts Flashing Bullish Signs

Peering into the Bitcoin price charts, there are signals taking shape that have me feeling optimistic. We saw previous resistance levels flip into support — an encouraging sign of buying conviction at higher levels. On-chain metrics also catch my eye, with non-zero Bitcoin addresses now topping 50 million.

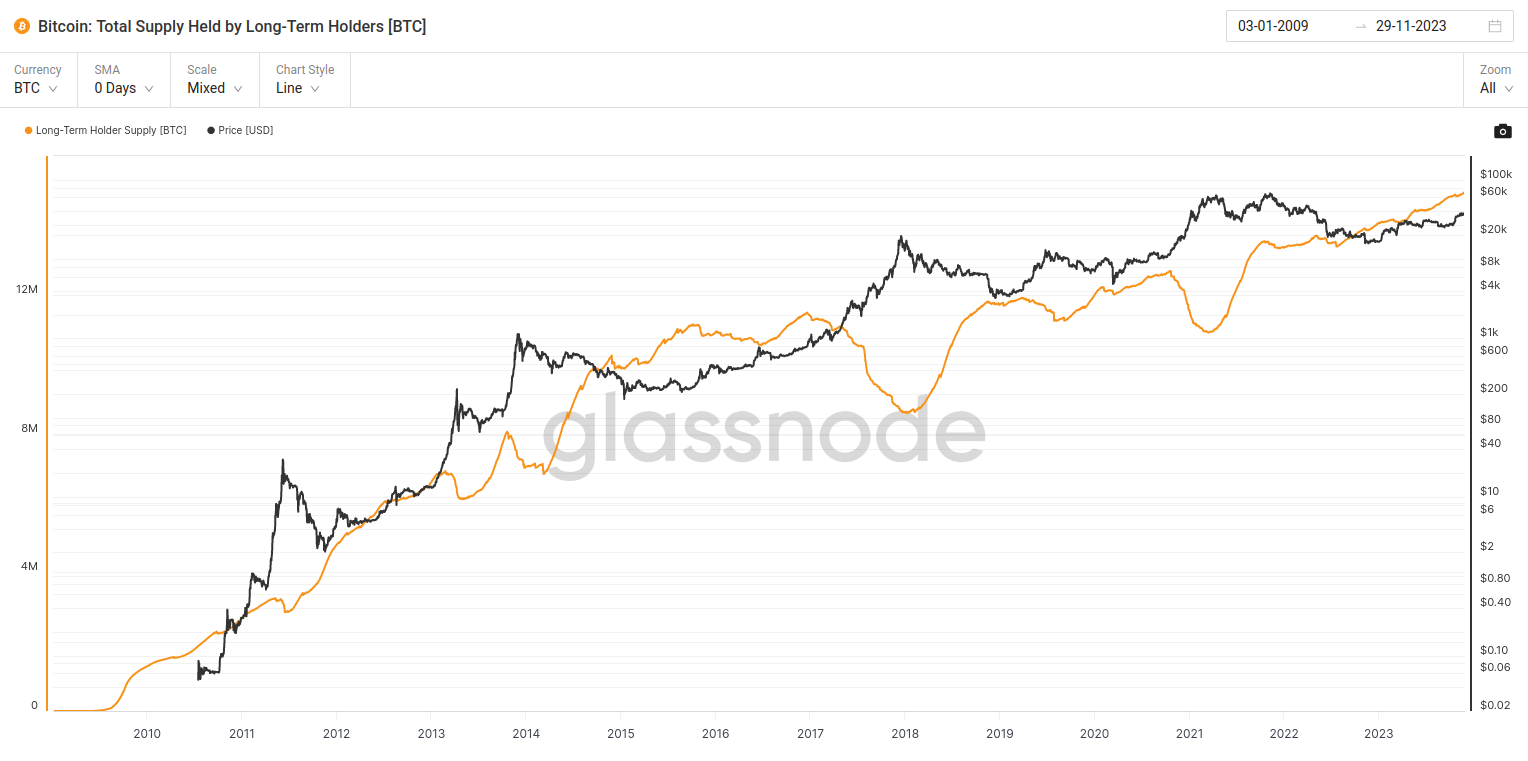

Wallet addresses holding Bitcoin (in orange) compared to the price of Bitcoin (in black). In previous bull markets, selling from long-term holders increased as we approached the peak. At present, long-term holders are steadily accumulating indicating they don’t believe we are at peak price.

Greater adoption equals greater acceptance in my book. Meanwhile, open interest and volumes on futures paint a picture of traders jockeying for positions ahead of anticipated gains. Technically and fundamentally, it seems updrafts are brewing. The anticipated SEC approval of a Spot ETF, a weakening U.S. Dollar Index (DXY), and the lowest liquid supply of Bitcoin all provide tailwinds to its price.

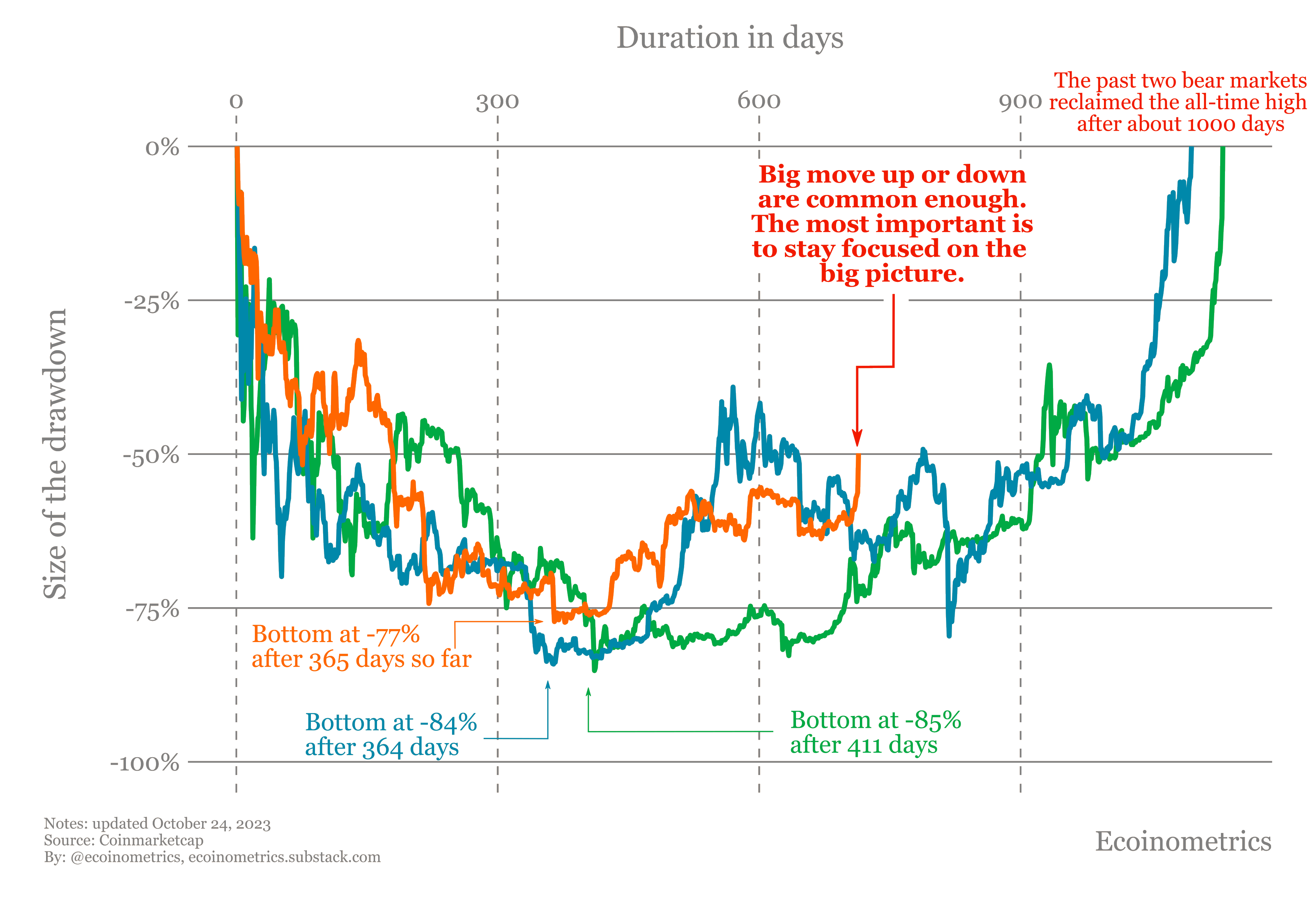

Not saying that past is prologue, but would you bet against this chart?

Macro Alignment Heightens Potential Volatility

Zooming out, the broader macro backdrop appears to be aligning in Bitcoin’s favor as we look ahead to 2024. Market analysts are calling for Fed rate cuts to commence around March 2024. Make special note of that timing, because it just so happens to synchronize closely with Bitcoin’s next halving event, when mining rewards get cut in half. Halvings tighten supply and have historically been catalysts for parabolic bull runs. If these dynamics converge alongside recessionary conditions that tend to benefit hard assets, we could see fireworks.

Solana Growth Metrics Position It as Ethereum Disruptor

Bitcoin isn’t the only blockchain protocol showing impressive growth signals — Solana merits attention as well. By processing over 50 million transactions daily, Solana is exhibiting the early traits of a classic disruptor, outmatching Ethereum on speed and scalability. As developers take notice and build dApps on Solana, we could be seeing the next “Facebook displacing MySpace” of crypto networks. Venture funding and developer hiring paint the same picture — Solana as a rising rival to Ethereum’s smart contract dominance.

Play-to-Earn Gaming May Unlock Adoption Floodgates

Speaking of disruptors, gaming is the 800-pound gorilla of entertainment with 3 billion participants globally. The play-to-earn model bringing real economic rewards onto gaming platforms poses huge disruptive potential. Embed digital asset ownership and wealth creation into something as innately appealing as gaming, and you’ve built a pretty darn alluring on-ramp to crypto and Web3 engagement. If this use case gets legs, we could see a tidal wave of gamers adopt crypto tools without even knowing it. Exciting times ahead.

Meme Coin Mania Captures Investment Psyche

On the topic of speculation, even rather absurd meme coins are seeing irrational exuberance right now. Though their lack of substance has me skeptical on fundamentals, interpretation of price action shows animal spirits are alive and well! In newcomers like Bonk, we’re watching speculative gambling override sober risk analysis, echoing historical bubbles. But this reveals a human tendency of wishful thinking to manifest self-fulfilling prophecies in asset prices, for better or worse.

Dogecoin Debate — Jester or Contender?

The OG meme coin Dogecoin provokes lively debate on this question as well. Critics argue DOGE’s enduring classification as a “joke currency” disqualifies its candidacy for real utility. However, Elon Musk continues hinting at integrations on Twitter or Tesla. Given how heavily his tweets already influence Doge prices, actual adoption could provide underlying substance. Perhaps there is room in the crypto pantheon for a court jester besides the blue chip contenders like Bitcoin — a role Dogecoin inhabits with its outsized media profile.

Lightning Adoption Falls Short of Expectations

In contrast to Solana’s observable on-chain usage growth, Bitcoin’s Lightning Network is lagging expectations as a scaling savior despite its technical elegance. Factors like centralized node influence, capital lockup requirements, and UX difficulties have inhibited adoption so far. Sentiment seems to be shifting from previous excitement that Lightning would unlock hyperbitcoinization visions of global microtransaction ubiquity. Back to the drawing board for Bitcoin’s scaling roadmap it appears…

DEXs and DeFi Emerging as Future Crypto Infrastructure

While Lightning stalls, fresh innovations in decentralized exchange protocols and DeFi networks offer new on-ramps into the crypto ecosystem. Trading volumes conducted on DEX platforms now capture meaningful and rising market share compared to centralized exchanges, as users discover the benefits of trustless security and ownership provability. As blockchain rails continue maturing, migration from Web2 seems increasingly inevitable across financial use cases.