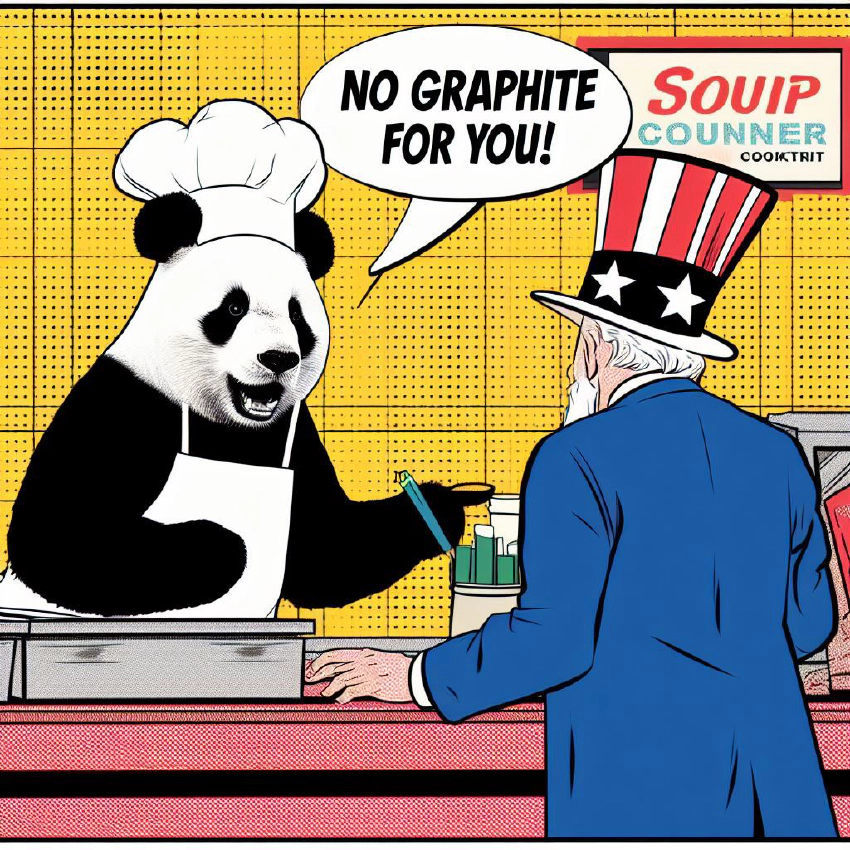

No Graphite For You!

What China’s New Export Restrictions Mean for the EV Industry

News broke this week that China is introducing export permits on graphite starting December 1st. This is a huge development that will have major implications across the EV supply chain.

Why Graphite? Why Now?

China controls over 90% of the natural graphite processing used in EV batteries. Of all the critical minerals, graphite is where China’s dominance is unmatched. By limiting exports, China can leverage this position of power. Industry players believe this move came earlier than expected, but given the strategic importance of graphite, it’s unlikely to be the last export restriction we see.

Make no mistake, this is a calculated maneuver by China. Graphite exports are being restricted to capitalize on the surging demand from EV makers across the globe. China knows it has the industry over a barrel. By squeezing supply, China can bring prices up internationally while reducing domestic prices. This gives Chinese graphite assets a major cost advantage. It also makes non-Chinese suppliers more desperate for Chinese supply.

Impact on the Broader EV Supply Chain

In the short term, reduced supply will undoubtedly lead to price increases for graphite outside China. Producers in Africa, North America, and elsewhere are likely to benefit. But a total shift away from Chinese dependence will take years — if not decades — due to infrastructure constraints. Major players know they must reduce reliance on China, but cannot simply flip a switch.

This move gives China even greater leverage over the global EV supply chain. They control the dominant supply of a critical mineral that the entire industry relies on. Any automaker or battery producer looking to scale EV production is now at the mercy of China’s graphite exports. This could give China bargaining power in trade negotiations and partnerships moving forward.

“Oh, you want us to buy more of your agricultural products? Well we can talk about that, but it sure would be a shame if graphite exports slowed down…”

Where Do We Go From Here?

While Chinese supply will remain critical over the next 5-10 years, investments must be made to develop graphite resources outside China for the long-term. Companies that can execute have enormous potential as demand skyrockets. However, it takes billions of dollars and many years to build new mines and processing facilities.

The bottom line is that China has strategically played its hand to capitalize on its immense graphite advantages. This will have ripple effects across the entire EV industry. The days of cheap and abundant graphite appear to be numbered. End-users will be playing on China’s terms for some time. The race is on to develop alternative supply chains, but this will be a marathon, not a sprint.