In investing, opportunities often arise from the most unlikely places. The "double negative" scenario—where both a market and an industry within that market are at low points—offers asymmetric risk-reward potential. Today, we examine if such a setup exists in Canada, where a weak Canadian dollar (the "loonie") and a struggling oil sands industry present a compelling case for contrarian investors.

The Canadian Oil Sands – A Perfect Storm

The Tariff Threat and Its Impact

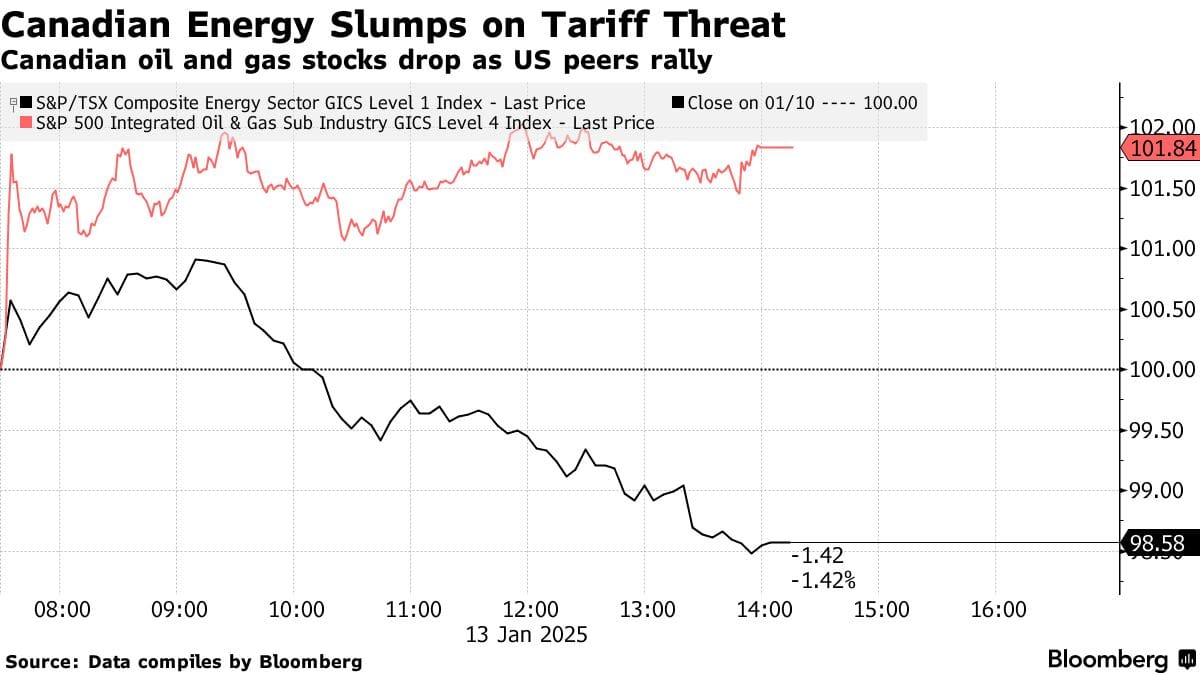

The Canadian oil sands industry, a cornerstone of the nation’s economy, faces significant headwinds. The primary concern? Tariff threats from the incoming Trump administration. Alberta Premier Danielle Smith’s recent meeting with Trump at Mar-a-Lago yielded no assurances, leaving Canadian oil producers in a precarious position. The fear of tariffs has already sent shockwaves through the market, with Canadian oil and gas stocks tumbling even as their U.S. counterparts rallied.

Key Data Points:

- Canada exports approximately 4 million barrels of oil per day, with over 90% going to the U.S.

- Heavy oil from the oil sands accounts for nearly half of the crude processed by U.S. Midwest refineries.

- Stocks like MEG Energy (OTCPK:MEGEF) fell 6.2% in a single day, while integrated players like Suncor Energy (SU) remained flat.

The Divergence Between Canadian and U.S. Producers

The divergence in stock performance between Canadian and U.S. energy producers is stark. Canadian heavy-oil producers, which rely heavily on U.S. markets, are the most exposed. Companies like Cenovus Energy (CVE) and Canadian Natural Resources (CNQ) are particularly vulnerable, while those with U.S. refineries, such as Suncor, are better positioned.

Consider: If tariffs are imposed, how much further can Canadian oil stocks fall, given they are already trading at depressed levels?

The Loonie’s Decline – A Symptom of Broader Issues

The Policy Gap Between the Fed and the Bank of Canada

The Canadian dollar has been under significant pressure, driven by a growing policy gap between the Federal Reserve and the Bank of Canada (BoC). While the Fed has signaled a pause in rate cuts, the BoC is expected to continue easing, with rates potentially dropping to 2% by mid-year. This widening gap is exacerbating the loonie’s weakness.

Key Data Points:

- The loonie is currently trading at 69.57 cents U.S., with RBC (a major Canadian bank) forecasting a further decline to 68.95 cents by Q2 2024.

- The U.S. economy remains robust, with a strong jobs report reducing expectations of Fed rate cuts.

- Canada’s economy, meanwhile, continues to underperform, with weak domestic demand pushing prices lower.

Inflation and Currency Spiral Risks

A weaker loonie typically raises concerns about inflation, as imported goods become more expensive. However, RBC economists believe that this risk is overstated. Only 20% of Canadian consumer spending is on imported goods, and just half of that comes from the U.S. Moreover, Canada’s net creditor status provides a natural hedge against currency weakness, reducing the risk of a downward spiral.

Consider: With the loonie already near historic lows, how much further can it fall before it becomes a tailwind for exporters?

The Double Negative Opportunity

Limited Downside, Significant Upside

The beauty of a double negative setup lies in its asymmetry. Both the Canadian dollar and the oil sands industry are at or near their lows, meaning the downside is limited. Investors can gain exposure at a significant discount to global peers, and if either factor improves—tariff fears ease or the loonie stabilizes—investors stand to benefit. If both improve, the returns could be substantial.

Key Data Points:

- The oil sands industry is trading at depressed valuations, with many stocks down 30-50% from recent highs.

- The loonie’s weakness makes Canadian assets cheaper for foreign investors, potentially attracting capital inflows.

Historical Precedents

History is replete with examples of double negative setups leading to outsized returns. Consider the U.S. housing market in 2009 or the tech sector in 2002. In both cases, investors who bought at the bottom reaped significant rewards as conditions improved.

Is the current setup in Canada such an opportunity?

How I Would Play This

Several factors could spur a turnaround in the double negative setup:

- Resolution of Tariff Threats: A clear resolution or reduction in tariff fears could lead to a re-rating of Canadian oil stocks.

- Stabilization of the Loonie: If the BoC signals an end to rate cuts or the U.S. economy shows signs of slowing, the loonie could stabilize.

- Global Oil Demand Recovery: A rebound in global oil prices would benefit Canadian producers, particularly those with low breakeven costs.

Trade Ideas for Investors

For investors willing to bet on a turnaround in one of the most unloved sectors in one of the most unloved markets, here are some ideas to consider:

- Heavy Oil Producers: Stocks like MEG Energy (MEG) and Cenovus Energy (CVE) are highly leveraged to a recovery in oil prices and tariff resolution.

- Integrated Players: Companies like Suncor Energy (SU) and Imperial Oil (IMO) offer a more balanced risk profile, with downstream operations providing a hedge against upstream volatility.

- Midstream and Infrastructure: Enbridge (ENB) and TC Energy (TRP) provide exposure to the oil sands with lower commodity price risk, thanks to their fee-based business models.

It's best to focus on high-quality names with strong balance sheets and low breakeven costs. Don't get "cute" digging through small caps for potential 50 baggers.

Conclusion

I need not remind you of the famous Warren Buffett quote, "Be fearful when others are greedy, and greedy when others are fearful." Today, fear is palpable in Canada’s oil sands and currency markets.

The double negative is a rare setup, but when it appears, it often leads to outsized returns. After all, there is only so far you can fall out the basement window.