When India and Russia announced their rupee-ruble deal to trade oil, bypassing the US dollar, it generated quite a buzz. But for Russia, this deal has not turned out to be as beneficial as they had hoped. Russia is now saddled with a growing pile of rupees it can't easily spend abroad. Supporters argue there are ways Russia can invest the rupees in India or use them for bilateral trade. But in my view, the challenges outweigh the opportunities.

For starters, Russia's ballooning rupee reserves have limited usefulness outside of India. As much as Russia would like to see the rupee become a global currency, it simply isn't. Russia can't readily use rupees to pay for much-needed imports like vehicles, electronics, and machinery on the international market. Of course, if India decided to dramatically expand the range of products it manufactures domestically and will accept rupees for, that would help.

Will India try and convince Russia to invest its growing rupee reserves into India's manufacturing sector to help build the products Russia needs long term?

Seems logical. However, Russia's needs are immediate – they want to purchase finished goods from abroad right away. Investing to build up India's manufacturing fails to solve that pressing objective. Russia likely has little appetite to act as a venture capital fund for India's long-term industrial ambitions. Russia's interests lie in buying ready-made imports wherever possible, rather than pouring revenue into developing another country's future production capacity.

Some suggest creative financial engineering like currency swaps could enable Russia to trade rupees beyond India. But from my understanding, complex financial mechanisms engineered to circumvent economic reality tend to collapse when conditions inevitably shift. There are simply too many moving parts. If the rupee's value itself erodes, which we’ve seen happen in the past, Russia loses purchasing power no matter what financial tools they employ.

India also has the upper hand in the relationship, since it can effectively control rupee convertibility into goods. Don't expect them to allow Russia to drain their economy of real commodities like gold or rice in exchange for rupees. They want to maximize oil imports, period.

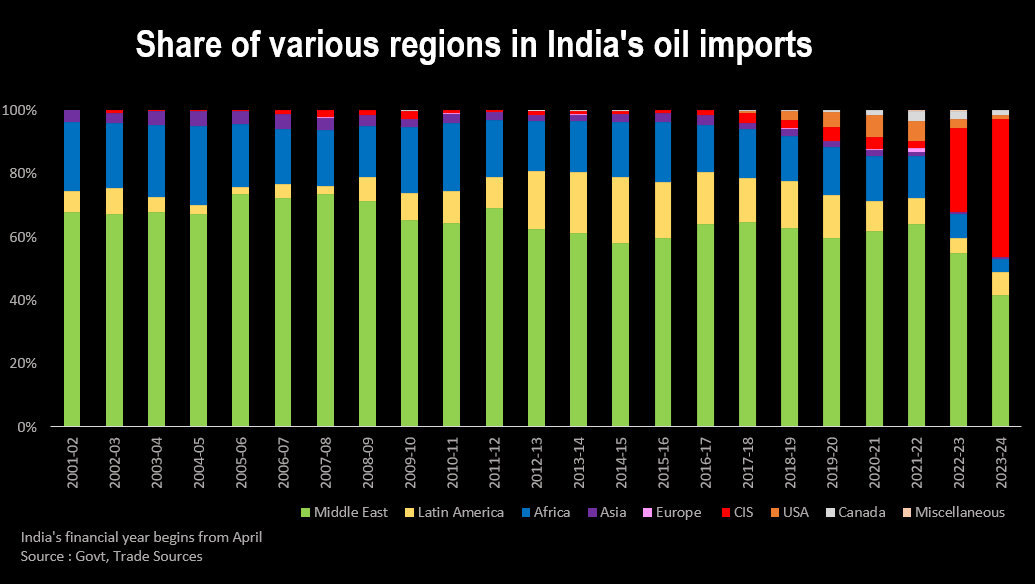

Of course, if India agreed to dramatically increase its intake of Russian oil, it would support expanded bilateral trade and boost rupee demand. But India also has strong incentives not to put all its eggs in Russia's basket. It has already increased Russian oil purchases ten-fold since the Russian-Ukraine war. With Russian oil making up 40% of oil imports, India will likely not go further in an effort to remain diversified. Too much reliance on Russian energy could leave them exposed.

The bottom line is that currencies and imports matter more than exports for Russia's economic prospects. If those rupees can't be exchanged for the imported machinery, electronics, vehicles and other goods Russia needs, their value is limited.

For now at least, I remain unconvinced Russia's ballooning rupee reserves will fill the gap left by restricted access to dollars and other globally accepted currencies. Over the long run, real economic fundamentals always reassert themselves.