The Hidden Asian Dragon

The combination of reasonable valuations relative to growth prospects, ongoing recovery in Asian economies, and potential currency tailwinds creates multiple drivers for Asian outperformance.

The combination of reasonable valuations relative to growth prospects, ongoing recovery in Asian economies, and potential currency tailwinds creates multiple drivers for Asian outperformance.

The whole S&P 500 market rally is being carried by a handful of mega-cap names while 90-95% of stocks are just sitting there. When only 5% of stocks drive index performance while economic fundamentals show early warning signs, it's worth considering hedges.

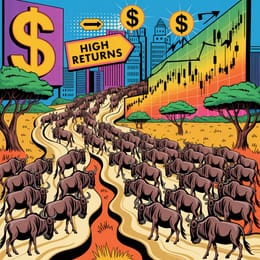

Wall Street's most reliable pattern: How following the money and its impact on demand beats forecasting demand in a world obsessed with narratives.

For over two years, the Fed has raised rates at the fastest pace in decades, yet inflation remains above its 2% target. Why? A big part of the answer lies in a phenomenon called fiscal dominance.

NVIDIA’s stock soared to new heights last week, only to reverse sharply. It's left me cautious if not bearish on the stock.