How Running From Gasoline Is Actually Driving Up Oil Use

Electric vehicles (EVs) are often promoted as a way to reduce our reliance on oil and gasoline-powered transport. However, an analysis of the market data seems to indicate that the frenzied global push into EVs is having the opposite effect — it is actually increasing oil consumption, not reducing it as commonly believed.

This counterintuitive finding stems from the complex petrochemical demands involved in manufacturing the components and materials that go into building EVs at scale. While EVs eliminate gasoline demand from the transport sector, their production requires a tremendous increase in other oil-derived products. Let's take a closer look at why this is happening.

The Surge in China's EV Industry

The exponential rise of China's EV industry is a major factor behind this trend. Figures published by the China Association of Automobile Manufacturers (CAAM) state in 2023 alone, around 9.5 million EVs were sold in China, up from just under 3 million units in 2020. The country now accounts for over half of total global EV sales.

This rampant growth is being driven by generous government subsidies, investments in charging infrastructure, as well as legislation that promotes and even mandates EVs. For automakers hoping to tap into the world's largest car market, developing electric models has become an urgent priority.

The Petrochemical Inputs Behind EVs

However, constructing EVs requires far more than just batteries and electric motors. The average EV contains around 750 pounds of petroleum-based plastics and synthetic materials — considerably more than a conventional gasoline-powered vehicle.

The seats, dashboards, bumpers, trim components and various insulation materials are generally made from specialized high-grade plastics and polymer composites that maximize durability while minimizing weight. The glues, rubbers, foam, coatings and sealants also derive from oil and gas feedstocks.

EV batteries and battery management systems rely heavily on petrochemical products at various stages of the production process. When you add it all up, EVs have an exceptionally high petrochemical intensity compared to legacy automobiles.

Petrochemical Demand Skyrockets in China

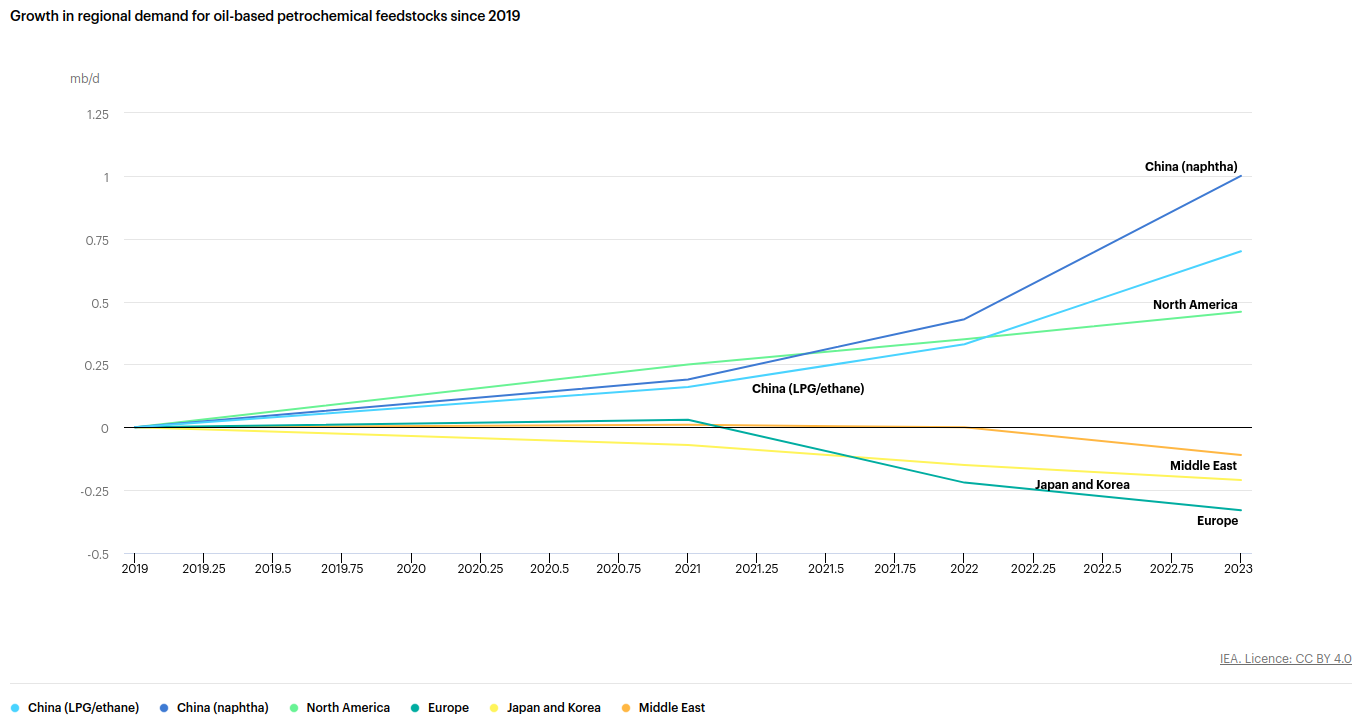

As Chinese EV output has soared, so too has the country's demand for key petrochemical building blocks like Naphtha and Liquefied petroleum gas (LPG), which are primarily used as input materials in the petrochemical industry. The IEA chart below shows that in 2023, China's Naphtha and LPG demand growth surged significantly.

Could this demand growth be tied directly to the chemical inputs required for the record-breaking EV volumes Chinese factories are churning out?

Aramco's recent multi-billion dollar petrochemical joint venture agreements with Chinese firms seems to further support this thesis. The state-owned oil giant clearly sees massive future demand growth for oil-derived chemical products in China stemming from EV production rather than the opposite.

Recalculating EV Oil Displacement

So where does this leave EV's potential to displace oil demand from transportation? The numbers are far less optimistic than conventionally reported.

Let's return to those 9.5 million EVs sold in China last year. Replacing the gasoline consumption of these 9.5 million EVs equals about 270,000 barrels per day. However, once we factor in all the incremental petrochemicals essential to manufacturing these same EVs, the net oil demand increase is estimated to be around 600,000 barrels per day — more than double the simple gasoline displacement tally.

This difference between reported and actual oil demand reduction from EVs only looks set to increase going forward. EV sales growth is being mandated encouraged globally while petrochemical-based components remain deeply embedded throughout these vehicles.

The Outlook for Oil in an EV Future

While hopes are high that EVs will free us from oil, the reality is that decoupling transportation from petroleum is proving far more challenging than anticipated. Even in a scenario where EVs capture 50% or more of the global car market by 2040, oil is likely to remain the world's leading source of transportation fuel.

Moreover, overall oil demand may never peak due to growing petrochemical usage not only in EVs but across a myriad of sectors and products that rely on these versatile hydrocarbons for their superior cost, efficiency and performance. Plastics, packaging, clothing, circuit boards, cosmetics and medical devices are just some everyday examples.

So while you may see more Tesla vehicles on the road each year, oil's vital role as a raw material for the chemicals and materials underpinning modern life appears only to be growing stronger each year. Our civilization is far more petroleum powered than simple statistics reveal — even as we race ahead, our roots remain firmly in the oil beneath our feet.