Juggling Inflation, Credibility, and Market Expectations

As we approach the Federal Reserve's pivotal press conference this Wednesday, it's becoming increasingly clear that this event will be a defining moment for the financial markets this year. The Fed finds itself in a precarious position, trying to balance persistent inflation, maintain its credibility, and manage market expectations, all while walking a tightrope with no safety net. It's a task that would make even the most seasoned circus performer break into a cold sweat.

Inflation: The Beast That Won't Be Tamed

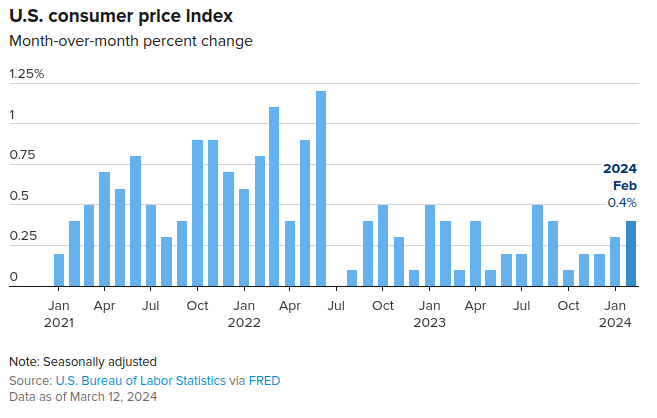

The Fed has been grappling with inflation like a lion tamer trying to control a particularly unruly big cat. Despite their best efforts, the recent CPI and PPI numbers suggest that inflation has dug its claws in and refuses to let go.

The data is clear: inflation is unlikely to fall significantly from its current levels, leaving the Fed in a bind as they prepare to update their projections for future rate hikes.

Will they acknowledge the persistence of inflation and change course, or will they stick to their guns and risk disappointing the markets?

The SEP: A High-Stakes Circus Act

Every other meeting, the Fed unveils its Summary of Economic Projections (SEP), a document that might as well be written in flashing neon lights given the amount of attention it receives. This time around, the SEP will be scrutinized more closely than a tightrope walker's every step. If the Fed hints at higher rates than previously anticipated, it could send the markets tumbling like a trapeze artist missing their catch. On the other hand, if they stick to their rate-cutting script, the markets could soar like an acrobat flying through the air. It's a high-stakes circus act, and the Fed is the ringmaster.

Timing: The Juggling Act

As if the Fed didn't have enough balls in the air, it's well known that their window for cutting rates is smaller than a clown car. If they want to make a move, they'll have to do it in May, June, or July. Any later, and they risk being accused of playing politics in an election year, a surefire way to get booed off the stage. The upcoming SEP is like a flaming torch the Fed must juggle while riding a unicycle on a tightrope — one false move, and the whole act could go up in flames.

Credibility: The Tightrope Walk

The Fed's credibility is balanced on a tightrope, and they're walking it without a net. In December last year, they effectively promised to cut interest rates, and now they must deliver on that promise or risk falling into the abyss of lost credibility. Walking back on those projections now would be like a magician revealing their secrets — the illusion would be shattered, and the audience would be left disillusioned. In an election year, the last thing the Fed wants is to be seen as a sideshow act that can't keep its promises.

Fiscal Dominance: The Elephant in the Circus Tent

While everyone is focused on the Fed's highwire act, there's another performer waiting in the wings: the Treasury Department. With Janet Yellen and her team steering the ship of government spending, we may be witnessing the rise of fiscal dominance, the proverbial elephant in the circus tent. This isn't some fringe conspiracy theory — it's a concept that's been around for years, and it could mean that the markets will keep chugging along like a runaway locomotive, regardless of what the Fed does with interest rates. The question is, who's really running this circus?

The Powder Keg Beneath the Big Top

Despite the potential for continued market growth, there are some troubling signs lurking beneath the surface, like a powder keg hidden beneath the big top. Banks are sitting on unrealized losses, commercial real estate is looking shakier than a house of cards, and geopolitical tensions are threatening to snap supply chains like a tightrope. These risks are like a lit fuse waiting for a spark, and if something sets it off, the ensuing explosion could bring the whole circus crashing down.

The Debt Shell Game

In a move that can only be described as a financial shell game, the government plans to buy back its own debt with — wait for it — more debt. It's like a magician trying to make their debt disappear by shuffling it around under a series of cups. Sure, it might work for a little while, but eventually, someone's going to lift the cup and reveal the truth. The Fed will need to be careful not to let this debt shell game get out of hand, or the entire illusion could come crashing down.

Conclusion

As the Fed prepares to take center stage this Wednesday, the stakes couldn't be higher. Will they be able to juggle inflation, credibility, and market expectations without dropping the ball? Will fiscal dominance steal the show and make the Fed's act irrelevant? Will the risks lurking beneath the surface finally rear their ugly heads and bring the big top crashing down?

I have no idea what is going to happen. But that's what makes the Fed Circus the greatest show on earth.