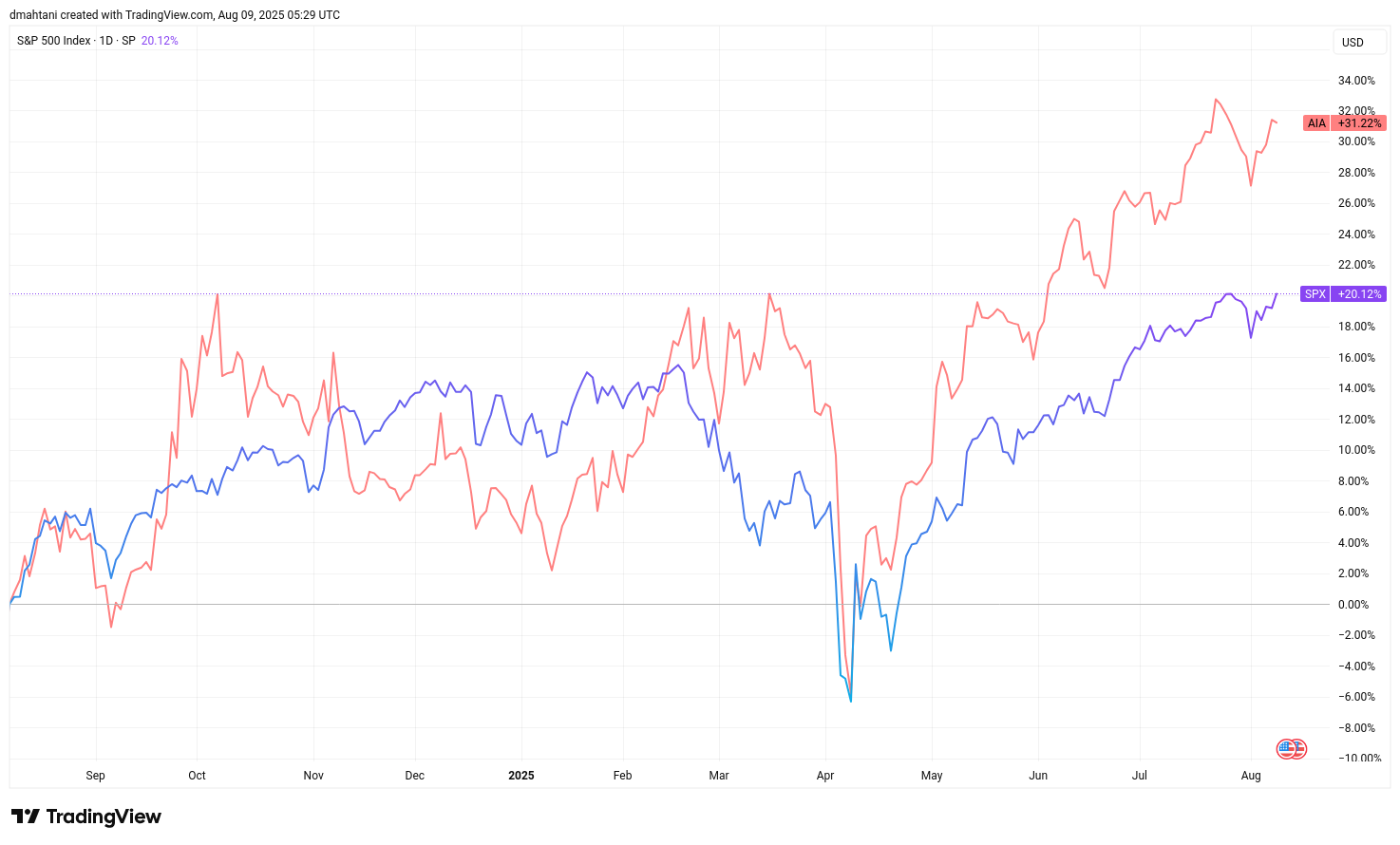

The S&P 500 has delivered impressive gains over the past year, with returns exceeding 20% that continue to reward global investors' confidence in US markets. This performance reflects the strength and resilience of American companies, and there's good reason to believe the S&P 500 will continue to be a cornerstone of most international portfolios for years to come.

However, while investors worldwide have been rightfully focused on this familiar success story, they may be overlooking equally compelling opportunities developing in other corners of the global market. One such story is the iShares Asia 50 ETF (AIA) which has quietly delivered approximately 31% gains over the past year, significantly outperforming even the strong S&P 500 returns while providing access to some of Asia's highest-quality growth companies.

This post isn't about abandoning successful US investments, but rather recognizing that some of the world's most dynamic growth stories are unfolding beyond American markets. For investors seeking to enhance their portfolios with broader global diversification, Asia's performance deserves serious consideration.

The Case for Diversification Beyond the US

The S&P 500's success has been built on solid fundamentals, with companies delivering 11.3% earnings growth in 2024 and projecting similar growth for 2025. However, this success has also led to premium valuations, with the market now trading at 27-29x earnings. While these valuations don't necessarily signal trouble ahead, they do suggest that much of the future growth expectations are already reflected in current prices.

This creates an opportunity for diversification into other regional markets where similar quality companies may be trading at more attractive entry points—which is where the iShares Asia 50 ETF (AIA) becomes particularly interesting as a complementary holding.

Asia's Quality Companies at Better Valuations

The fund, managed by BlackRock with approximately $844 million in assets, focuses on the 50 largest and most liquid Asian companies across key markets including China, Hong Kong, Taiwan, South Korea, and Singapore. What makes AIA particularly attractive is its concentration of holdings in companies that are not just regional leaders, but global powerhouses in their respective industries.

Taiwan Semiconductor Manufacturing (TSMC) commands the largest position at 22.76% of the portfolio. As the world's most advanced semiconductor foundry, TSMC manufactures chips for virtually every major technology company, from Apple to NVIDIA. The company sits at the epicenter of the artificial intelligence boom, producing the cutting-edge processors that power everything from data centers to autonomous vehicles. While AI stocks in the US trade at eye-watering valuations, TSMC offers more reasonable access to this same technological revolution.

Tencent Holdings represents 12.44% of the fund and provides exposure to China's vast digital ecosystem. Far more than just a gaming company, Tencent operates WeChat (China's dominant messaging and payments platform), cloud services, and numerous other digital properties that touch virtually every aspect of Chinese consumer life.

Alibaba Group at 6.64% offers a recovery play on Chinese e-commerce and cloud computing. After facing significant regulatory pressure, Alibaba appears to be stabilizing and could benefit from its dominant position in China's massive consumer market.

Samsung Electronics (4.33%) provides exposure to South Korea's technology leadership in memory chips, smartphones, and consumer electronics, while trading at more reasonable valuations than many US technology names.

The fund's technology concentration continues with other significant holdings including Xiaomi, SK Hynix, Hon Hai Precision, and MediaTek, creating a portfolio deeply embedded in the global technology supply chain.

Beyond technology, AIA provides balanced exposure to Asia's financial powerhouses like DBS Group (Singapore's largest bank) and AIA Group (Asia's premier life insurer). Consumer discretionary holdings like Meituan (China's food delivery platform), BYD (electric vehicle manufacturer), and JD.com position investors to benefit from Asia's rising middle class and changing consumption patterns—companies that often trade at fractions of the valuations commanded by their US counterparts while addressing larger addressable markets.

The Smart Approach to Asian Market Exposure

Perhaps the most compelling aspect of AIA is how it solves the practical challenges of investing in Asian markets. Researching individual companies across China, South Korea, Taiwan, and Singapore requires understanding different accounting standards, regulatory environments, and market dynamics across multiple countries and languages.

AIA eliminates this complexity by providing professional management and access to the 50 largest, most liquid Asian companies through a single, globally accessible exchange-traded fund:

- Professional Due Diligence: BlackRock's research team handles the complex evaluation across different Asian markets and regulatory environments

- Global Accessibility: Easy buying and selling through existing brokerage accounts, without establishing Asian broker relationships or navigating foreign exchange transactions

- Regional Diversification: Risk spread across the region's most established businesses and multiple markets rather than betting on single companies or countries

- Cost Efficiency: Institutional scale provides access at costs that would be prohibitive if building similar exposure directly

Why Now Makes Sense

The current environment presents a particularly attractive entry point for Asian exposure. While US markets command global attention and premium valuations, Asian markets have been quietly executing their own growth stories without the same level of international investor focus. This attention gap often creates opportunities for patient investors willing to look beyond the headlines.

The combination of reasonable valuations relative to growth prospects, ongoing recovery in Asian economies, and potential currency tailwinds creates multiple drivers for continued outperformance. Rather than chasing momentum in crowded US markets, AIA allows positioning ahead of broader investor recognition of Asia's quality companies.

AIA provides access to many of the same technological and demographic trends that drive enthusiasm for US investments—the global AI and semiconductor revolution through companies like TSMC and Samsung, plus exposure to Asian financial services and consumer companies benefiting from the region's rising prosperity. For investors maintaining strong US exposure while seeking thoughtful global diversification, Asia's quality companies deserve consideration in today's market environment.

The quiet performers often deliver the loudest results.