The uranium bull market continues to rage based on recent developments. While more flashy predictions about triple-digit prices grab headlines, insights from industry experts help reaffirm the backbone supporting a prolonged bull run. An update on key metrics driving this niche sector reinforces the positive investment case rather than mere euphoria.

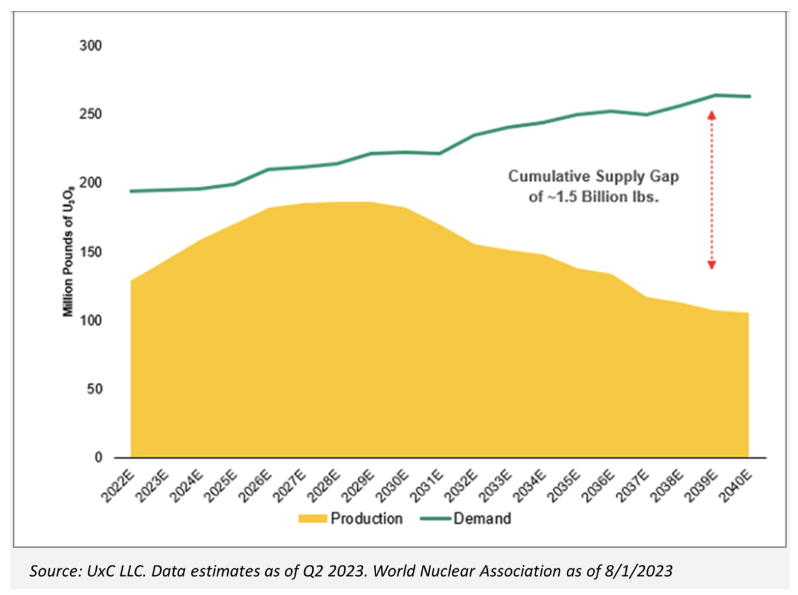

The widening supply gap remains the crux providing gusto to this bull. Even accounting for higher prices stimulating new mine output, projections still show a 40m lb annual deficit between global reactor demand and mining supply after 2030. Known projects in the pipeline fail to offset substantial decline rates anticipated at aging stalwart operations. And the absence of secondary supply sources that cushioned past cycles means this tangible shortage should directly translate to competition and higher prices.

The proof lies in renewed long-term contracting critical for this industry. After years of atrophy, contracting volumes finally edged over 160m lbs last year. However, while an improvement, this remains shy of fully replacing the 180m lbs burned up annually. With uncovered demand ahead, experts anticipate the race to lock in future supply signalling the start of an intense contracting cycle akin to the frenzied activity witnessed in the mid-2000s.

However, a far wider actual deficit today could see an even more explosive response.

So despite the doubles and triples already registered from recent lows, uranium equities remain drastically undervalued based on historical cycle precedents. This indicates plentiful upside remains once this bull captivates a broader audience. And while emerging technologies like sea water extraction and laser enrichment show promise, their influence lies too distant to solve the supply gap facing the nuclear industry this decade.

Variables around geopolitics and infrastructure development do muddy the waters as to precisely how high and for how long this bull can run before the cure for high prices arrives. But barriers around financing and constructing complex fuel projects imply it will take drastically longer than headlines imply. Across the mosaic of metrics, the economic essentials supporting this thesis remain intact, with shortages poised to breed multi-year gains until the equilibrium is restored.