Every market is a theater of perpetual motion, where trends emerge, speculation overtakes, and corrections restore. In recent weeks, the spotlight has been on NVIDIA, a semiconductor giant that has become a bellwether for AI, the tech sector and, by extension, the broader market. But as NVIDIA’s stock soared to new heights last week – only to reverse sharply – it's left me cautious if not bearish on the stock.

NVIDIA’s Icarus Moment: A Warning for Tech Investors?

NVIDIA’s recent price action has been nothing short of dramatic. The stock opened at a new all-time high following a bullish news announcement, only to reverse sharply and close near its lows—a classic “Icarus Print.” This pattern, named after the Greek myth of Icarus flying too close to the sun, often signals a near-term top in a stock’s price. For tactical traders, this is a red flag.

The magnitude of the reversal was significant, with NVIDIA sliding two standard deviations from its peak—a rare event that underscores the fragility of the current rally. The stock has now landed in technical support, but the damage may already be done. Historically, such reversals have preceded extended periods of consolidation or outright declines.

But what does this mean for the broader market?

Semiconductors have been a key driver of the Nasdaq’s rally, and if NVIDIA’s weakness spreads to other chip stocks, it could trigger a broader selloff. Apple, for instance, has already been struggling, trading near its lows despite being the largest stock in the index.

This makes me cautious. When the leaders falter, the followers often follow suit.

The Dollar’s Resilience: A Headwind for Commodities?

The U.S. Dollar Index (DXY) has been grinding higher, recently touching 109. This strength in the dollar has been a headwind for commodities, which typically move inversely to the greenback.

So, why is the dollar so strong? The dollar’s strength is likely a reflection of global risk aversion. But part of the answer also lies in the bond market. The 10-year Treasury yield has surged to 4.7%, its highest level since last year, as the Federal Reserve’s easing cycle has failed to curb inflation expectations. I'm no expert on yield curves, but from what I have read a steepening yield curve — now at a positive 43 basis points — is a classic sign of economic uncertainty.

But what happens if the dollar weakens? A pullback in the dollar could provide a tailwind for commodities, particularly gold. Gold has been forming a bullish wedge pattern, and a breakout could signal a resumption of its uptrend.

Gold: The Silent Outperformer

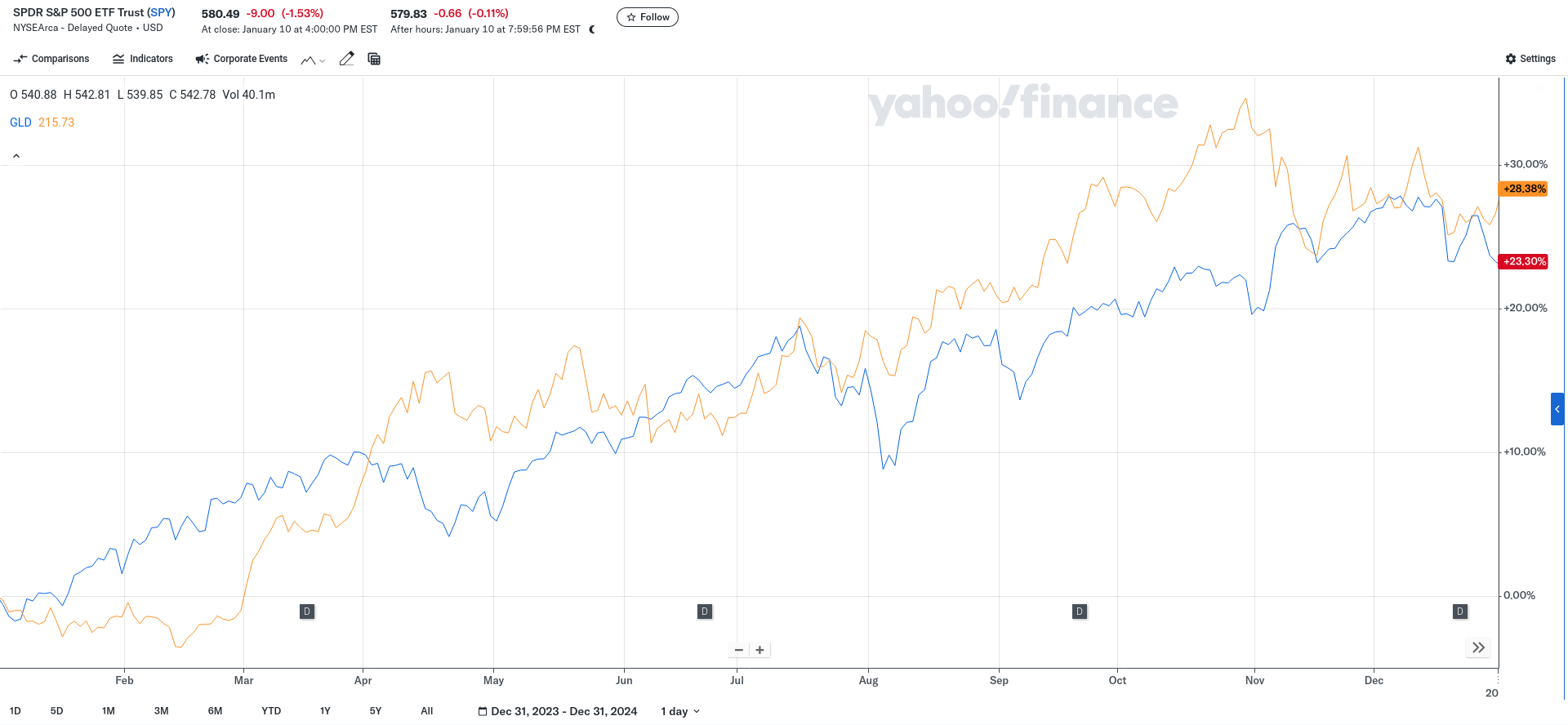

Gold had a stellar year in 2024, slightly beating the performance of the S&P 500, yet it remains underappreciated by the broader market. This lack of attention is surprising, given gold's historical role as a safe-haven asset and its ability to preserve wealth during periods of economic uncertainty.

Several factors support a continued bullish outlook for gold:

- Inflation Hedge: Gold has historically performed well during periods of rising inflation, which remains a key risk in the current environment.

- Diversification Benefits: Gold's low correlation with other asset classes makes it an effective portfolio diversifier.

If you are concerned about the broader stock market, it may not be a bad idea to add some exposure to gold, either through physical holdings or gold-related equities, as a hedge against market volatility and inflation.

The Bond Market’s Message: Recession or Reflation?

The bond market is often referred to as the “smart money,” and its recent behavior has been sending mixed signals. On one hand, the steepening yield curve suggests that investors are bracing for a recession. On the other hand, the Fed’s dovish rhetoric—with officials like Christopher Waller calling for more rate cuts in 2025—implies that policymakers are more concerned about borrowing costs than inflation.

So, who’s right? The answer may lie in the economic data. While job openings increased slightly in November 2024, the overall trend shows a significant decline from the peak in March 2022, with jobseekers facing longer job search times and reduced worker turnover due to a softening labor market. High interest rates have also suppressed hiring in key sectors, indicating weaker labor demand and economic conditions.

The trend towards labor market weakness could be the canary in the coal mine for a broader economic slowdown. If the data continues to deteriorate, it could force the Fed to accelerate its rate-cutting cycle, which would be bullish for stocks, bonds, and crypto, while being bearish for the dollar.

Trade Ideas: Positioning for Uncertainty

It's hard to know what to do when the market is giving you mixed signals. Given the current dynamics, here are a few trade ideas to consider if you have exposure:

- NVIDIA (NVDA): If you’re in profit on your NVIDIA position, you could consider selling off a small portion of your holdings and use the proceeds to buy put options on the rest of your position. Think of it as insurance—if NVIDIA pulls back, the put options will help mitigate losses while keeping your remaining position exposed to any further upside.

- Gold (GLD): Gold’s bullish wedge pattern and resilience in the face of a strong dollar make it an attractive hedge against economic uncertainty. If you’re looking for a safe haven, this could be worth a look.

- Floating-Rate Bonds: Consider floating-rate bonds, which adjust their interest payments based on changes in benchmark rates. These bonds can provide stability and income in a rising rate environment, acting as a hedge against market volatility.

- S&P 500 (SPX): If you’re in profit on your S&P 500 position, consider selling a small portion and buying put options on the remaining position. This provides downside protection in case the index breaks below key support levels, such as 5800, which could trigger a sharp selloff.

Conclusion: My Plan for 2025

As we enter a new year, I plan to spend more time than ever thinking critically about what I own in my portfolio and why I own it. If the reason to own a stock disappears, then the stock must disappear. The markets may be complacent, but that is no reason for investors to be.

I also need to start regularly asking myself:

Do my capital allocations allow me to remain nimble in a changing market?

Whether it’s positioning for a potential recession, hedging against dollar weakness, or capitalizing on sector-specific opportunities, the next few months are likely to present both challenges and opportunities. As investors, we must plan to take advantage of – not be taken advantage of – the market.