The Economic Landscape

The economic data signals some concerning trends. Car loan delinquencies are at record highs, with over 6% of borrowers at least 60 days late. This indicates consumer financial strain even with ultra-low auto loan rates over the past decade. Permanent job losses are also on the rise, typically a precursor to recessions as firms make cuts ahead of downturns. Even the Fed is cutting jobs — for the first time in more than a decade.

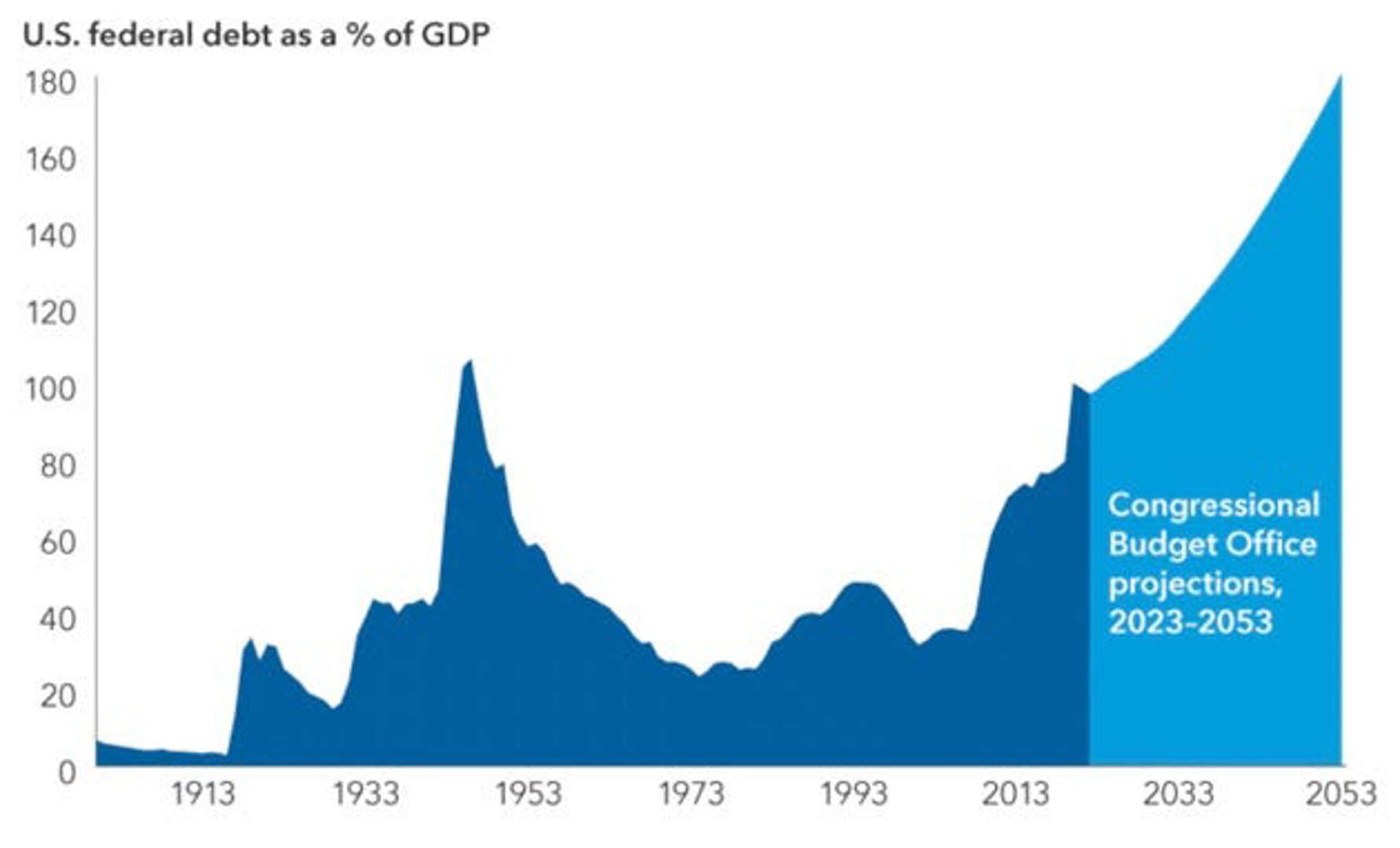

Most alarming is the reckless US government spending and deficits. The budget deficit now exceeds $2 trillion annually even amidst supposed economic prosperity. Interest costs on the ballooning debt are approaching $1 trillion per year. Total US debt has jumped by $650 billion in just one month and $2 trillion since 2020.

This paints a picture of the US caught in a debt spiral. Massive deficits will drive higher inflation, requiring more stimulus and threatening the US dollar's strength. There is no political will in Washington to cut spending or balance budgets. The conclusion is we are set up for a period of heavy money printing by the Federal Reserve to monetize deficits once economic cracks appear.

The idea that interest payments could soon surpass defense spending could be a source of concern for policymakers, with President Joe Biden pledging Monday to ask Congress for over $100 billion worth of funding to support both Israel and Ukraine.

While the timing is uncertain, expect further economic deterioration over the next 6-12 months as rate hikes impact the economy. Deteriorating labor markets will be the clearest signal of recession.

Stock Market Outlook: Vulnerable to Economic Weakening

The stock market outlook is precarious despite major indices holding near all-time highs. The gains are largely concentrated in a handful of mega-cap tech stocks, typical of late-cycle bull markets before substantial corrections.

With bond yields spiking, stocks look extremely overvalued relative to risk-free treasury yields. This suggests funds will migrate out of equities into safe fixed income as economic risks mount. Significant equity declines likely require job losses and recessionary conditions that impact consumer spending and confidence.

Until clear economic capitulation, the largest technology stocks may continue benefiting from passive inflows. But below the surface, deteriorating fundamentals will eventually weigh on sentiment.

Sectors I am Watching

Gold Caught a Bid

Gold prices have already risen due to recent geopolitical tensions. Once rates start falling again and quantitative easing resumes, that should signal the all-clear for gold's next leg up.

Many quality miners have lagged the move in gold itself, creating a divergence that has left them undervalued. As gold powers higher, these stocks should stage a bull run. For investors positioned in gold before the crowd catches on, the next decade could prove to be a Golden Age indeed.

Uranium’s Slow March Higher

The uranium market continues its slow but steady climb higher, with prices now reaching $73 per pound. I remain bullish on uranium’s prospects going forward. This steady increase appears likely to persist, as the challenges facing global energy supplies will drive more demand for nuclear power and the uranium needed to fuel it.

The incentive is clear for uranium miners to boost production, but new mines take time to develop. Supply will struggle to keep pace if demand rises rapidly. That mismatch suggests the potential for much higher uranium prices in coming years.

Oil: Is a Storm Coming?

Geopolitical tensions and supply uncertainty have led to increased volatility in the oil markets. However, I believe these risks are just the beginning of a gathering storm for oil prices. As global spare production capacity shrinks, the oil market grows ever more susceptible to potential shocks.

Oil companies face a reckoning, as existing reserves naturally decline without massive new investments. The push for carbon-free energy has provided oil producers with little incentive to invest in exploring and developing future reserves. With air travel now exceeding pre-pandemic levels, the potential for an oil squeeze escalates should conflict or sanctions hit key producers.

While the upside for oil prices appears substantial if supplies tighten further, timing any bullish move remains challenging. Investors should anticipate geopolitical volatility spilling over into the black gold market.